America’s most famous holiday is nearly here! But no need to panic. With two whole weeks until Tax Day, you still have a dozen restless nights before self-appointed experts slam you with opinion columns like “How to Make Past Years’ Charitable Donations Today,” “Smuggle Yourself to an Offshore Tax Shelter with These Perfectly Legal Steps,” and “What If My Extension Lasts Longer Than Four Hours?”

I will have you know that this column is different. I have never ordained myself as an expert—the label adheres itself to geniuses (like me) who invent brilliant ideas (such as mine) for not paying taxes.

Before I spill the magic beans, you must absolve yourself of any cloying sense of duty to your community. You may feel that your tax dollars are hard at work paving roads, managing sewage, feeding your neighbors in their times of hardship, and housing Belgians in OUR International Space Station.

But to prove that your personal tax dollars make no difference whatsoever, I offer this litmus test: Without your wind beneath its wings, will the space station tumble from orbit, sparing the crushed bystanders from hearing another Nickelback song ever again?

Answer: Probably not, because I for one have never been so lucky.

Face it. Your taxes will not directly contribute to the common good. So you should find the most patriotic path to legitimate tax write-offs. And nothing is more American than saving yourself taxes at a baseball game.

That’s right—you can spend an hour’s wages on a Hobbit-sized cinnamon twist and consequently fork over less money to Uncle Sam, the bum.

To cement your trust in my wizardry, let’s take a look at:

TAX DEDUCTIONS AT PLAY

Your favorite columnist travels to Arizona for legitimate business purposes, even if those purposes are too intrinsic to the ethereality of journalism to document properly. He buys tickets to a spring training baseball game. With what money is left after convenience surcharges, he buys food for tailgating, souvenirs for his nephews, and a single lemonade. Over a dinner scavenged from ballpark trash cans, the columnist discusses legitimate business integration tactics.

Quiz: What part of this trip is tax deductible? (Hint: it’s not the business dinner. The columnist forgot to scavenge any itemized receipts, and the IRS does not assign a monetary value to botulism.)

Answer: Every single other expense is tax deductible. The critical clue here is often overlooked—your favorite columnist is a writer. Writing is his job! And he cannot be taxed on money spent for work-related outlays.

So he writes a segment of a column incorporating the specifics of his recreational expenses. To wit: “My nephews learned a great deal about respect by collecting autographs with a package of blue Bic pens and two Official Major League Baseballs. That life lesson happened directly because the Royals’ minor league players squeaked past the Reds’ minor league players 3-2. I’m glad we ate lunch beforehand, because the lemonade cost approximately the second baseman’s salary. Seriously, I have spied on third dates more affordable than that lemonade.”

Now that these expenses are integral to a published column, your favorite columnist may deduct them from this year’s income.

THIS CONCLUDES TAX DEDUCTIONS AT PLAY

Folks, that’s as simple as it sounds! And the Internal Revenue Code of the United States probably does not restrict or qualify this financial benefit in any way.

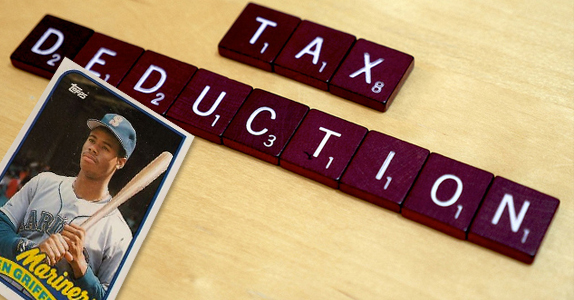

Of course, a puritanical work ethic is not the only way to earn tax write-offs. Retirement planning is another. I began hedging for retirement at the usual age (8) when I purchased the first of many packs of baseball cards.

This retirement strategy works almost precisely like buying mint-condition action figures, or a house:

-Prevent the investment from catching fire for several years;

-Set the inevitable hoards of desperate buyers at each other’s throats;

-Sell the investment at lemonade-level markups;

-Add the word “magnate” to your name plate.

I see no way in which such a simple plan could possibly ever fail me, unless, of course, everyone else also bought beaucoup baseball cards, at first inflating prices artificially and then bursting the bubble, leaving us long-term investors holding a bunch of expensive bookmarks.

No way that’s already happened! And since I jumped on this investment train so far ahead of the curve that I personally have more Ken Griffey Jr. rookie cards than friends, I should be set for a lifetime of financial freedom with no regrets.

Although, if I had the chance to do it all over again, I would advise eight-year-old me to stash his cash. He’ll need it, once he’s old enough to file his extensions with the proper authorities.

(Photo from Simon Cunningham / CC)

Responses to “Fool’s Gold: Tax Bases”