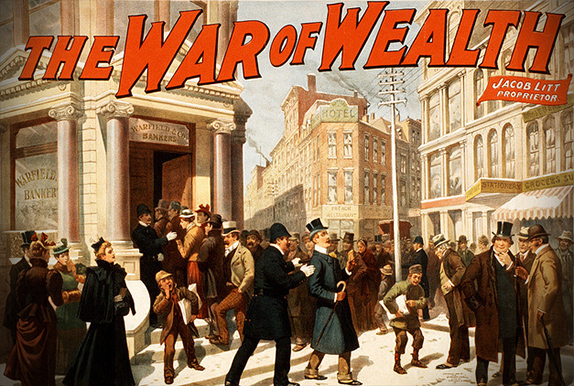

Inequality has returned to the United States. Americans are now faced, not only with huge disadvantages in economic competition; politically, we are faced with the rise of a new ruling class. This year's elections will feature cascades of money from billionaires, dwarfing the contributions of individuals for whom politics used to be, but no longer is, a way to seek revival.

This coagulation of riches that now threatens to clog the politics of the country has rendered our national Congress inert. The global banking system that used to provide financing for local business, for construction, for advances in health, education and welfare, has turned its attention to the Wall Street derivatives market; turned away from local requirements to prefer instead the global casinos of algorithmic chance. Community banks, locally owned banks, banks that had a direct relationship to the communities that they served, are becoming an endangered species while the big five banks no longer know the names of the families or businesses, the borrowers that they have packaged together in Collateralized Debt Obligations. To keep this whole scheme going, the financial industry, alone, has descended upon Washington DC with over 12,000 lobbyists. Any head-on assault by activists and concerned citizens, any resistance, runs into this overwhelming financial industry defense.

Here in New Mexico we have begun to explore alternatives to the current system. If the long-term axiom of economics is that, “Whoever controls the money supply, controls the empire," then let us find ways ourselves to improve our money supply. Let us find ways that are responsive to our own needs and do not foster the single-minded intentions of the Wall Street banks. Let us create our own banks, locally, funded by the reserves of our own local governments. Let us find a way to democratize our own economy, or that is, to bind together in a partnership our public and private needs.

City-owned banks can provide funding for local business, as well as rehabilitation for blighted areas, disaster relief, and environmental protections. But to make this all happen we need an educated public and a thoughtful process. To initiate this education and the process, to understand how to capitalize, manage, and direct a public bank's mission toward a combination of public and private purposes, we begin with a symposium. On September 27, at the Santa Fe Community Convention Center, with registration beginning at 9:30 AM, and a program running through the day featuring experts from around the country, we will lay the groundwork. Nationally recognized advocates such as Richard Wolff and Ellen Brown will explain both the conditions that require change and the places in which such changes have already occurred. The public is invited. Admission for the full day is $40. Scholarships are available and can be obtained by going to the website bankingonnewmexico.org.

The symposium is hosted by the nonprofit group We Are People Here!, by the Public Banking Institute, and by Santa Fe's Mayor Javier Gonzales. Together we can find a way to take control of our own world.

One further item: if you're looking for inspiration and have not yet got a taste for banking; don't yet see how or why it could be the lever to change our financial dependence on Wall Street, join us for a special presentation of readings from history of the voices of our ancestors who have cried out for change. This inspiring combination of voices of men and women, people of color, laboring people, and all those who have stood outside the citadels of power over the centuries will give you a sense of possibility and hope. The performance will be at El Museo Cultural, in Santa Fe, beginning at 7 PM on September 26, the night before the symposium. Admission is free.

Responses to “Bringing Democracy to Banking”